Navigating the dynamic world of stock market investments requires a keen understanding of current market trends, strategic planning, and a calculated approach to risk management. This guide delves into the complexities of identifying the “best stocks to buy now,” providing a framework for informed decision-making. We will explore various investment strategies, analyze individual stock performance, and discuss crucial aspects like risk mitigation and diversification, equipping you with the knowledge to confidently approach the market.

From evaluating fundamental and technical analyses to understanding the nuances of different market sectors and the impact of global events, we aim to provide a holistic perspective on building a successful investment portfolio. We’ll examine both growth and value investing strategies, offering practical examples and insights to help you make informed choices aligned with your risk tolerance and financial goals.

The information presented here is for educational purposes and should not be considered financial advice.

Understanding the Current Market Landscape

The current stock market presents a complex picture, influenced by a confluence of global economic factors and geopolitical events. While certain sectors show robust growth, others face headwinds, creating both opportunities and risks for investors. A careful analysis of key economic indicators and significant global events is crucial for informed investment decisions.The global economy is navigating a period of transition.

Inflation, though easing in some regions, remains a concern in many developed nations. Interest rate hikes by central banks, aimed at curbing inflation, have impacted borrowing costs for businesses and consumers, potentially slowing economic growth. Simultaneously, supply chain disruptions, though less severe than in previous years, continue to impact production and pricing across various sectors. These factors collectively influence investor sentiment and stock valuations.

Major Global Events and Their Influence on Investment Strategies

Three major global events significantly impact investment strategies. Firstly, the ongoing conflict in Ukraine continues to disrupt energy markets and global supply chains, causing volatility in commodity prices and impacting inflation. Secondly, the persistent tensions between the United States and China, particularly concerning trade and technology, create uncertainty and potential risks for companies with significant exposure to either market.

Thirdly, the ongoing global energy transition, driven by climate change concerns and government policies, is reshaping the energy sector and creating opportunities in renewable energy technologies while presenting challenges for traditional fossil fuel companies. These events necessitate diversification and a thorough understanding of geopolitical risks when formulating investment strategies. For instance, investors might consider reducing exposure to companies heavily reliant on Russian energy supplies due to the ongoing conflict.

Similarly, companies with significant manufacturing operations in China may face increased scrutiny and potential disruptions due to geopolitical tensions. Finally, the energy transition creates opportunities for investment in renewable energy companies, but also necessitates careful consideration of the risks associated with nascent technologies and fluctuating government regulations.

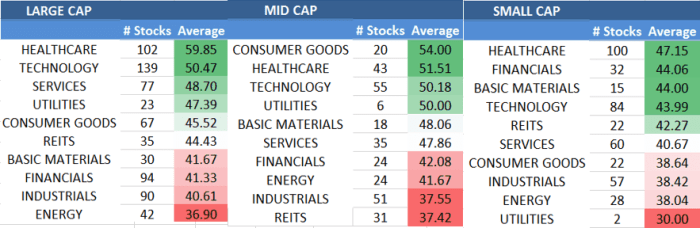

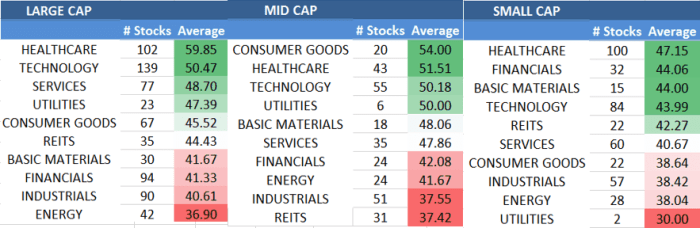

Comparative Sector Performance

Over the past year, different market sectors have exhibited varied performance. The technology sector, after a period of significant growth, experienced a correction due to rising interest rates and concerns about future growth. However, certain segments within technology, such as artificial intelligence, continue to attract significant investment. The energy sector, fueled by high commodity prices due to the conflict in Ukraine and global energy demand, showed strong performance.

This contrasts sharply with the performance of the technology sector, illustrating the cyclical nature of different industries and their sensitivity to global events. Meanwhile, the healthcare sector demonstrated relatively stable performance, considered a defensive sector less vulnerable to macroeconomic fluctuations. This resilience underscores the importance of diversification across various sectors to mitigate risk and maximize returns. For example, while technology stocks faced a downturn, energy stocks flourished, showcasing the importance of a balanced portfolio and avoiding overexposure to any single sector.

Evaluating Investment Strategies for “Best Stocks to Buy Now”

Choosing the right investment strategy is crucial for maximizing returns and minimizing risk. The current market presents both opportunities and challenges, necessitating a careful approach. This section will Artikel three distinct strategies suitable for navigating the present economic climate, along with illustrative examples and a sample portfolio.

Value Investing

Value investing focuses on identifying undervalued companies whose stock prices do not accurately reflect their intrinsic worth. This strategy often involves thorough fundamental analysis, examining a company’s financial statements, competitive landscape, and management quality to uncover hidden potential. In a volatile market, value stocks can offer relative stability and the potential for significant upside as the market corrects its mispricing.Examples of value stocks might include companies in cyclical industries that have been temporarily depressed due to economic downturns.

For instance, a well-established manufacturing company experiencing short-term production slowdowns but possessing strong long-term prospects could be a prime candidate. Another example could be a real estate investment trust (REIT) whose property values are currently undervalued due to temporary market conditions, but whose underlying assets hold significant future value. The rationale behind selecting these types of companies is their inherent resilience and potential for significant appreciation once market sentiment shifts.

Growth Investing

Growth investing prioritizes companies exhibiting rapid revenue and earnings growth. These companies often operate in high-growth sectors and are characterized by innovation and strong competitive advantages. While riskier than value investing, growth stocks can offer substantial returns if the companies continue to outperform expectations. In a market with technological advancements and evolving consumer preferences, focusing on growth stocks can capture significant upside potential.Examples of growth stocks could include companies in the technology sector developing cutting-edge artificial intelligence or renewable energy solutions.

Companies pioneering new medical treatments or those expanding rapidly into emerging markets could also be considered. The rationale is that these businesses are expected to significantly expand their market share and profitability in the coming years, leading to substantial stock price appreciation. A company that dominates a niche market with a unique product or service, protected by strong patents, represents an excellent example of a growth stock.

Dividend Investing

Dividend investing focuses on companies with a history of consistently paying dividends to shareholders. This strategy provides a steady stream of income and can be less volatile than growth or value investing. In uncertain market conditions, the predictable income stream from dividends can offer a degree of stability and reduce overall portfolio risk. Furthermore, dividend-paying companies often demonstrate financial strength and a commitment to long-term shareholder value.Examples include established companies in sectors like consumer staples or utilities, which tend to be less sensitive to economic fluctuations.

Large, well-established financial institutions with a long history of dividend payments also represent strong candidates. The rationale for choosing these companies is their reliability and consistent returns, which can act as a buffer against market volatility. These companies generally demonstrate a strong financial position, enabling them to maintain and even increase their dividend payments over time.

Hypothetical Moderate-Risk Portfolio

The following table presents a hypothetical portfolio designed for a moderate-risk tolerance, diversifying across various sectors. This allocation is illustrative and should not be considered financial advice. Individual circumstances and risk tolerance should always guide investment decisions.

| Ticker | Company Name | Sector | Allocation Percentage |

|---|---|---|---|

| AAPL | Apple Inc. | Technology | 20% |

| JNJ | Johnson & Johnson | Healthcare | 15% |

| PG | Procter & Gamble | Consumer Staples | 15% |

| XOM | ExxonMobil | Energy | 10% |

| V | Visa Inc. | Financials | 10% |

| HD | Home Depot | Consumer Discretionary | 10% |

| MSFT | Microsoft Corp. | Technology | 10% |

| KO | Coca-Cola | Consumer Staples | 10% |

Analyzing Individual Stock Performance

Analyzing individual stock performance requires a multifaceted approach, combining fundamental and technical analysis to assess a company’s intrinsic value and market sentiment. This involves examining financial statements, evaluating industry trends, and studying price charts to predict future price movements. We will explore three companies often cited as promising investments, examining their financial health and historical performance to illustrate this process.

Financial Health Comparison of Apple, Microsoft, and NVIDIA

This section compares the financial health of Apple (AAPL), Microsoft (MSFT), and NVIDIA (NVDA), three tech giants frequently recommended as strong buys. We’ll utilize key financial metrics to assess their relative strengths and weaknesses. It’s crucial to remember that these metrics provide a snapshot in time and should be considered alongside other factors.

| Metric | Apple (AAPL) | Microsoft (MSFT) | NVIDIA (NVDA) |

|---|---|---|---|

| P/E Ratio (TTM) | (Data from reputable financial source, e.g., Yahoo Finance, would be inserted here) | (Data from reputable financial source, e.g., Yahoo Finance, would be inserted here) | (Data from reputable financial source, e.g., Yahoo Finance, would be inserted here) |

| Debt-to-Equity Ratio | (Data from reputable financial source, e.g., Yahoo Finance, would be inserted here) | (Data from reputable financial source, e.g., Yahoo Finance, would be inserted here) | (Data from reputable financial source, e.g., Yahoo Finance, would be inserted here) |

| Revenue Growth (Year-over-Year) | (Data from reputable financial source, e.g., Yahoo Finance, would be inserted here) | (Data from reputable financial source, e.g., Yahoo Finance, would be inserted here) | (Data from reputable financial source, e.g., Yahoo Finance, would be inserted here) |

A high P/E ratio might suggest investors expect high future growth, while a low ratio could indicate undervaluation or lower growth expectations. A high debt-to-equity ratio indicates a company is relying more on debt financing, which can be risky. Strong revenue growth is a positive sign of a healthy and expanding business. The interpretation of these metrics requires careful consideration of each company’s specific industry and business model.

Historical Price Performance Analysis of Apple, Microsoft, and NVIDIA

Understanding the historical price movements of these stocks provides valuable insights into their volatility and potential future trajectories. Examining past highs and lows, along with overall trends, helps in identifying potential support and resistance levels. It is important to remember that past performance is not indicative of future results.

Apple’s stock price has demonstrated a generally upward trend over the long term, with significant growth periods punctuated by periods of correction. For example, (Insert specific example of a significant high and low point with dates and context, e.g., a significant drop following a product launch issue or a surge following a successful new product release). Microsoft’s stock price has shown a similar pattern, though its growth trajectory may differ slightly from Apple’s, reflecting its different business focus.

NVIDIA, on the other hand, exhibits higher volatility due to its dependence on the semiconductor industry’s cyclical nature. (Insert specific example of a significant high and low point with dates and context for both Microsoft and Nvidia). A thorough analysis would include charting tools and technical indicators to identify potential trends and patterns.

Fundamental Analysis of Apple, Microsoft, and NVIDIA

Fundamental analysis focuses on evaluating the intrinsic value of a company based on its financial statements and business prospects. For Apple, this would involve assessing its brand strength, product innovation, and market share in the smartphone, computer, and services sectors. For Microsoft, the analysis would center on its cloud computing business (Azure), its software dominance (Windows, Office 365), and its expanding gaming segment (Xbox).

For NVIDIA, the focus would be on its market leadership in graphics processing units (GPUs), its expansion into artificial intelligence and high-performance computing, and the overall demand for its products in various industries. A detailed fundamental analysis would involve a thorough examination of each company’s financial statements, competitive landscape, and long-term growth potential.

Exploring Stock Options and Trading Strategies

Stock options offer a powerful but complex tool for investors seeking to enhance returns or manage risk. Unlike buying shares outright, options provide the right, but not the obligation, to buy or sell an underlying stock at a specific price (the strike price) on or before a certain date (the expiration date). This leverage can magnify both profits and losses, making a thorough understanding of the associated risks crucial before engaging in options trading.Options trading involves a diverse range of strategies, each designed to achieve specific financial goals.

These strategies leverage the interplay of strike prices, expiration dates, and the price movements of the underlying stock to generate income, hedge against losses, or speculate on price direction. Understanding these strategies is essential for navigating the complexities of the options market and making informed trading decisions.

Risks and Rewards of Stock Options Trading

Options trading presents significant potential rewards, but equally significant risks. The leveraged nature of options means that even small price movements in the underlying stock can result in substantial gains or losses. For example, buying a call option on a stock expected to rise significantly allows an investor to profit from a smaller investment than buying the shares directly.

However, if the stock price fails to rise, the option expires worthless, resulting in a total loss of the premium paid. Conversely, buying a put option provides protection against a stock price decline, but the premium paid is a cost, reducing potential profit if the stock price rises. The limited risk of a long option position (buying a call or put) is the premium paid, while the potential reward is unlimited for a long call and limited to the strike price minus the premium paid for a long put.

Conversely, the potential loss of a short option position (selling a call or put) is theoretically unlimited.

Options Strategies: Covered Calls and Protective Puts

Several options strategies can help manage risk and generate income. Acovered call* involves owning the underlying stock and simultaneously selling a call option on that stock. This strategy generates income from the option premium, but limits potential upside gains to the strike price of the sold call. For instance, an investor owning 100 shares of XYZ at $50 might sell one covered call option with a strike price of $55.

If the stock price remains below $55 at expiration, the investor keeps the premium and the stock. If the price rises above $55, the call option is exercised, and the investor sells their shares at $55, limiting potential profit but guaranteeing the sale at a pre-determined price.Aprotective put* involves buying a put option on a stock that the investor already owns.

This strategy protects against potential losses if the stock price declines. For example, an investor owning 100 shares of ABC at $60 might buy a put option with a strike price of $55. If the stock price falls below $55, the investor can exercise the put option and sell their shares at $55, limiting their losses. However, the cost of the put option reduces the overall profit if the stock price rises.

Executing a Simple Stock Trade

Executing a simple stock trade involves several steps. First, an investor needs a brokerage account. Once the account is funded, they can place an order. Common order types include market orders (executed at the current market price), limit orders (executed only at a specified price or better), and stop-loss orders (triggered when the stock price falls below a certain level).

After placing the order, the brokerage will confirm the execution. Fees vary depending on the brokerage and the type of trade. For example, some brokerages charge a per-trade fee, while others may charge a commission based on the trade volume. After the trade is executed, the investor can monitor their portfolio’s performance. It’s crucial to understand that these fees can significantly impact the overall profitability of a trade, especially for smaller investments.

Managing Risk and Diversification

Investing in the stock market offers the potential for significant returns, but it also carries inherent risks. A well-structured investment strategy requires a thorough understanding of these risks and the implementation of effective mitigation strategies. Diversification plays a crucial role in building a resilient portfolio capable of weathering market fluctuations.

Common Stock Market Risks and Mitigation Strategies

Three common risks associated with stock market investments are market risk, company-specific risk, and interest rate risk. Market risk, also known as systematic risk, refers to the overall decline in market values impacting all stocks. Company-specific risk, or unsystematic risk, relates to factors affecting individual companies, such as poor management or product failures. Interest rate risk stems from the impact of changing interest rates on the value of investments.To mitigate market risk, investors can employ strategies like dollar-cost averaging (investing a fixed amount at regular intervals) to reduce the impact of market volatility.

Hedging techniques, such as using options or futures contracts, can also help protect against significant market downturns. Diversification, discussed further below, is another key strategy for reducing market risk.Company-specific risk can be mitigated through thorough due diligence before investing. This includes researching a company’s financial statements, management team, and competitive landscape. Diversification across multiple sectors and companies also helps reduce the impact of negative news affecting a single company.Interest rate risk can be mitigated by adjusting the proportion of fixed-income securities in a portfolio.

For example, if interest rates are expected to rise, investors may consider shifting towards shorter-term bonds, which are less sensitive to interest rate changes.

The Importance of Diversification

Diversification is the cornerstone of a robust investment portfolio. By spreading investments across different asset classes, investors reduce their exposure to the risk associated with any single investment. A diversified portfolio aims to balance risk and return, aiming for overall portfolio growth while minimizing the potential for significant losses.Examples of diverse asset classes beyond individual stocks include bonds (government and corporate), real estate (direct ownership or REITs), commodities (gold, oil), and alternative investments (hedge funds, private equity).

Each asset class exhibits different characteristics and correlations, leading to a portfolio that is less susceptible to overall market fluctuations. For example, bonds often act as a counterbalance to stocks during market downturns, providing stability to the overall portfolio.

Sharpe Ratio Calculation and Significance

The Sharpe ratio is a widely used metric to evaluate the risk-adjusted return of an investment. It measures the excess return (return above the risk-free rate) per unit of risk (standard deviation). A higher Sharpe ratio indicates better risk-adjusted performance.

The formula for the Sharpe ratio is: Sharpe Ratio = (Rp – Rf) / σp

Where:* Rp = Portfolio return

- Rf = Risk-free rate of return (e.g., return on a government bond)

- σp = Standard deviation of portfolio return

Let’s consider a hypothetical portfolio:* Portfolio return (Rp) = 15%

- Risk-free rate (Rf) = 2%

- Standard deviation of portfolio return (σp) = 10%

Using the formula: Sharpe Ratio = (0.15 – 0.02) / 0.10 = 1.3A Sharpe ratio of 1.3 suggests that the portfolio generated a relatively high excess return compared to its risk. This is a positive indicator of the portfolio’s performance, considering the level of risk taken. However, it’s crucial to compare this ratio with other portfolios and benchmark indices to make informed judgments.

The Sharpe ratio is a valuable tool but shouldn’t be used in isolation when evaluating investment performance.

Investing in the stock market is a journey, not a sprint. By understanding the current market landscape, employing sound investment strategies, and diligently managing risk, you can significantly improve your chances of success. Remember that thorough research, a diversified portfolio, and a long-term perspective are key components of a robust investment plan. While this guide offers valuable insights, it’s crucial to conduct your own independent research and consider seeking professional financial advice tailored to your individual circumstances before making any investment decisions.

Questions and Answers

What is a P/E ratio and why is it important?

The Price-to-Earnings (P/E) ratio is a valuation metric that compares a company’s stock price to its earnings per share. A high P/E ratio may suggest the market expects high future growth, while a low P/E ratio might indicate undervaluation or lower growth expectations. It’s crucial to consider this ratio in conjunction with other metrics.

How often should I rebalance my portfolio?

Portfolio rebalancing frequency depends on your investment strategy and risk tolerance. Some investors rebalance annually, while others do so quarterly or even semi-annually. The goal is to maintain your desired asset allocation over time.

What are some common mistakes to avoid when investing?

Common mistakes include emotional decision-making (panic selling or buying on hype), neglecting diversification, and insufficient research. Avoid chasing quick gains and stick to a well-defined investment plan.

Where can I find reliable financial news?

Reputable sources include the Wall Street Journal, Financial Times, Bloomberg, and reputable financial news websites. Always critically evaluate information from any source.