Navigating the world of stock options can feel daunting, but understanding the basics empowers you to participate in potentially lucrative investment strategies. This guide demystifies the process, providing a clear path from understanding fundamental concepts to placing your first trade. We’ll explore different option types, risk management techniques, and essential considerations for successful options trading.

From opening a brokerage account and funding it appropriately to executing trades and managing risk, we’ll cover every step. We’ll also delve into advanced strategies, providing illustrative examples to solidify your understanding. This guide is designed to equip you with the knowledge to confidently explore the opportunities and challenges presented by the options market.

Understanding Stock Options Basics

Stock options are derivative instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset (typically a stock) at a predetermined price (the strike price) on or before a specific date (the expiration date). Understanding the nuances of options trading is crucial before engaging in this potentially high-reward, high-risk market.

Call Options and Put Options

There are two main types of stock options: call options and put options. A call option gives the buyer the right to

- buy* the underlying asset at the strike price, while a put option gives the buyer the right to

- sell* the underlying asset at the strike price. Both options expire on a predetermined date. The choice between a call or a put depends entirely on the trader’s market outlook. A bullish outlook (expecting price increase) would favor call options, while a bearish outlook (expecting price decrease) would favor put options.

Key Terminology in Options Trading

Several key terms are essential to understanding options trading. The

- strike price* is the price at which the option holder can buy (call) or sell (put) the underlying asset. The

- expiration date* is the date after which the option becomes worthless if it hasn’t been exercised. The

- premium* is the price paid by the buyer to acquire the option contract. This premium represents the cost of the right, but not the obligation, to exercise the option. Understanding these terms is fundamental to interpreting option pricing and evaluating potential profits or losses.

How a Stock Option Trade Works: A Step-by-Step Guide

1. Understanding Market Sentiment

The trader analyzes market trends and makes a prediction about the future price movement of a specific underlying asset.

2. Choosing an Option Type

Based on their prediction (bullish or bearish), the trader selects either a call or a put option.

3. Selecting Strike Price and Expiration Date

The trader chooses a strike price and expiration date that aligns with their trading strategy and risk tolerance.

4. Placing the Order

The trader places an order through their brokerage account, specifying the option type, strike price, expiration date, and the number of contracts they wish to buy.

5. Monitoring the Trade

The trader monitors the price of the underlying asset and the option’s value leading up to the expiration date.

6. Exercising or Letting Expire

Before the expiration date, the trader decides whether to exercise their right to buy or sell the underlying asset at the strike price or let the option expire worthless. If the option is profitable, exercising may be favorable. If not, letting it expire is the best course of action to limit losses.

Comparison of Call and Put Options

| Feature | Call Option | Put Option |

|---|---|---|

| Objective | Profit from price increase | Profit from price decrease |

| Risk | Limited to premium paid | Limited to premium paid |

| Potential Reward | Unlimited (theoretically) | Limited to the strike price |

| Best Use Case | Bullish market outlook | Bearish market outlook |

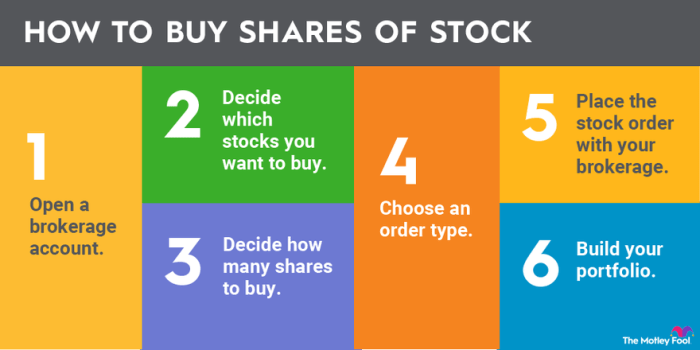

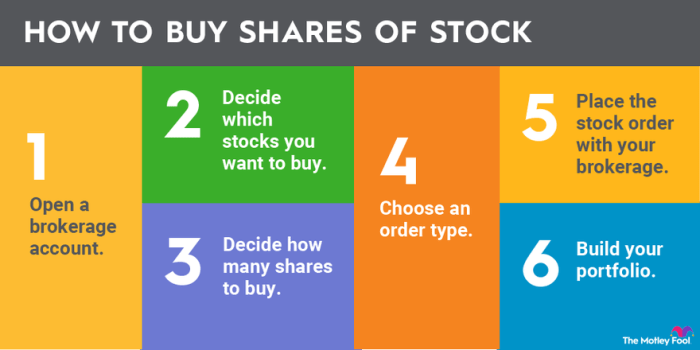

Opening a Brokerage Account

Opening a brokerage account is the crucial first step in your options trading journey. Choosing the right platform and understanding the account opening process are essential for a smooth and efficient trading experience. This section will guide you through the process, comparing different brokerage platforms, outlining the account opening procedure, and detailing associated fees.

Brokerage Platform Comparison

Several brokerage platforms cater to options traders, each with varying features, fees, and user interfaces. The best choice depends on your individual needs and trading style. Consider factors such as trading fees, platform usability, research tools, educational resources, and customer support when making your decision. For example, some platforms, like Fidelity and Schwab, are known for their robust research tools and educational resources, while others, such as Interactive Brokers, are favored for their advanced trading platforms and lower commissions.

Robinhood, while user-friendly, may lack the advanced features some options traders require.

Account Opening Process and Required Documentation

Opening a brokerage account typically involves completing an application form online, providing personal identification (such as a driver’s license or passport), and confirming your address. You will likely need to provide your Social Security number (SSN) or taxpayer identification number (TIN) for tax reporting purposes. The brokerage will verify your identity and may conduct a background check. Some brokerages may require a minimum deposit to open an account, while others may not.

It’s important to carefully review the specific requirements of the brokerage you choose.

Account Opening Checklist

Before you begin, it’s helpful to have a checklist to ensure a smooth process.

- Choose a brokerage platform.

- Gather required documentation (ID, proof of address, SSN/TIN).

- Complete the online application form accurately.

- Fund your account (if required).

- Review and accept the brokerage’s terms and conditions.

- Wait for account approval and confirmation.

Brokerage Account Fees and Commissions

Brokerage fees and commissions can significantly impact your profitability. These fees can include account maintenance fees, inactivity fees, commissions per trade, and fees for specific services like margin accounts or options trading. Some brokerages offer commission-free trading for certain asset classes, while others charge a per-trade fee that varies depending on the volume and type of trade. It’s crucial to compare fee structures across different platforms before making a decision.

For instance, while Interactive Brokers may offer lower commissions per trade for high-volume traders, a smaller brokerage might charge a flat fee per trade, making it potentially more cost-effective for infrequent traders. Always review the complete fee schedule provided by your chosen brokerage.

Risk Management Strategies for Options Trading

Options trading presents significant opportunities for profit, but it also carries substantial risks. Understanding and mitigating these risks is crucial for successful and sustainable trading. Effective risk management isn’t about avoiding all risk; it’s about intelligently managing exposure to achieve your trading goals while minimizing potential losses.Options trading involves inherent risks due to the leveraged nature of the contracts.

The potential for rapid price movements and the time-sensitive nature of options (expiration dates) contribute to the complexity of risk assessment. Ignoring these risks can lead to significant financial losses.

Common Risks Associated with Options Trading

Options trading exposes traders to several key risks. These include the risk of time decay (theta), where the value of an option diminishes as it nears expiration, regardless of the underlying asset’s price movement. Another significant risk is volatility risk, as options prices are heavily influenced by changes in the underlying asset’s volatility. Furthermore, there’s the risk of assignment, where the option buyer is obligated to fulfill the contract terms (buying or selling the underlying asset), and the risk of early assignment, which can disrupt a trader’s strategy.

Finally, the potential for large losses due to leverage, if not carefully managed, is a serious consideration.

Strategies to Mitigate Options Trading Risks

Several strategies can help mitigate the risks associated with options trading. Diversification is crucial; spreading investments across different options and underlying assets reduces the impact of any single losing trade. Proper position sizing, determining the appropriate number of contracts to trade based on your account size and risk tolerance, is vital. Using stop-loss orders, which automatically sell an option when it reaches a predetermined price, limits potential losses.

Thorough research and understanding of the underlying asset’s fundamentals, and the option’s characteristics, including its strike price, expiration date, and implied volatility, are also paramount.

Comparison of Risk Management Techniques

Different risk management techniques offer varying levels of protection. For instance, hedging strategies, such as buying protective puts to limit potential losses on a long stock position, offer downside protection but at the cost of reduced potential gains. Conversely, covered call writing generates income but limits upside potential. Each technique has its own risk-reward profile, and the optimal choice depends on the trader’s risk tolerance and investment goals.

A conservative trader might favor hedging strategies, while a more aggressive trader might opt for strategies with higher potential returns but greater risk.

Risk Management Best Practices for Options Traders

A robust risk management plan is essential for options trading success. This should include:

- Defining clear trading goals and risk tolerance levels before entering any trade.

- Developing a disciplined trading plan that Artikels entry and exit strategies, stop-loss levels, and position sizing.

- Thoroughly researching and understanding the underlying asset and the options contracts before trading.

- Regularly monitoring positions and adjusting strategies as needed.

- Continuously learning and adapting to market conditions and improving trading skills.

- Maintaining accurate records of all trades and analyzing performance to identify areas for improvement.

- Never investing more than you can afford to lose.

Understanding the Stock Market and Stock Trading

The stock market is a complex ecosystem where buyers and sellers trade shares of publicly listed companies. Understanding its fundamentals is crucial for successful stock trading, whether you’re dealing with stocks directly or utilizing options based on them. This section will explore the basics of the stock market, common order types, several trading strategies, and a brief overview of fundamental and technical analysis.

Stock Market Fundamentals

The stock market facilitates the buying and selling of company ownership. When you buy stock, you become a shareholder, owning a tiny fraction of that company. Share prices fluctuate based on supply and demand, influenced by factors like company performance, economic conditions, investor sentiment, and news events. Profits are generated through the appreciation of share value (selling at a higher price than purchased) and dividends (periodic payments from the company’s profits).

Major stock exchanges, like the New York Stock Exchange (NYSE) and Nasdaq, provide a regulated platform for these transactions. The market’s overall health is often reflected in indices like the Dow Jones Industrial Average or the S&P 500, which track the performance of a basket of selected stocks.

Types of Stock Orders

Different order types allow investors to specify how and when they want to buy or sell stocks. A market order executes immediately at the best available price, while a limit order only executes if the price reaches a specified level. A stop-loss order automatically sells a stock if it falls below a certain price, limiting potential losses. A stop-limit order combines aspects of both stop and limit orders, offering more control over the execution price.

Understanding these order types is crucial for managing risk and achieving desired outcomes. For instance, a stop-loss order might be used to protect against significant losses in a volatile market.

Stock Trading Strategies

Numerous strategies exist for trading stocks, each with varying levels of risk and potential reward. Value investing focuses on identifying undervalued companies with strong fundamentals, aiming for long-term growth. Growth investing targets companies with high growth potential, even if they are currently overvalued. Day trading involves buying and selling stocks within a single day, aiming to profit from short-term price fluctuations.

Swing trading holds stocks for a few days or weeks, capitalizing on intermediate-term price movements. Momentum investing follows stocks that are experiencing strong upward price trends. The choice of strategy depends on individual risk tolerance, time horizon, and market outlook. For example, a long-term investor might prefer value investing, while a more risk-tolerant trader might opt for day trading or momentum investing.

Fundamental and Technical Analysis

Fundamental analysis evaluates a company’s intrinsic value based on its financial statements, management quality, competitive landscape, and industry trends. It aims to determine whether a stock is trading above or below its true worth. Technical analysis, on the other hand, focuses on price charts and trading volume to identify patterns and predict future price movements. It uses indicators and chart patterns to identify potential buy and sell signals.

Many investors use a combination of both fundamental and technical analysis to make informed trading decisions. For example, a fundamental analyst might identify a company with strong earnings growth, while a technical analyst might use chart patterns to determine the optimal entry and exit points.

Advanced Options Strategies

Now that we’ve covered the fundamentals of options trading, let’s delve into some more sophisticated strategies that can offer greater potential rewards—but also carry significantly higher risk. These strategies involve combining multiple options contracts to create defined risk profiles and potentially enhance returns. It’s crucial to understand the complexities and potential downsides before implementing them.

Option Spreads

Option spreads involve simultaneously buying and selling options contracts of the same underlying asset with different strike prices or expiration dates. This strategy limits potential losses while potentially maximizing profits within a defined range. A common example is the bull call spread, where an investor buys a call option with a lower strike price and simultaneously sells a call option with a higher strike price, both with the same expiration date.

This strategy profits most when the underlying asset’s price rises significantly, but the maximum profit is capped. Conversely, a bear put spread involves buying a put option with a higher strike price and selling a put option with a lower strike price. This strategy profits when the underlying asset’s price falls. The maximum profit is limited, but the potential losses are also capped.

Understanding the break-even points and maximum profit/loss for each spread is crucial for successful implementation.

Covered Call Writing

Covered call writing involves selling call options on an underlying asset that the investor already owns. This strategy generates income from the option premium while limiting potential upside gains on the underlying asset. The maximum profit is limited to the sum of the stock’s current price plus the premium received from selling the call option. However, the investor faces the risk of having their shares called away at the strike price if the option expires in-the-money.

This strategy is often employed by investors who are bullish on the underlying asset but are willing to forgo some potential upside for immediate income. For example, an investor holding 100 shares of XYZ at $50 might sell one covered call contract with a strike price of $55. If the price stays below $55, the investor keeps the premium and the shares.

If the price rises above $55, the shares are called away, but the investor still profits from the price appreciation up to $55 plus the premium.

Protective Puts

Protective puts involve buying a put option on an underlying asset that the investor already owns or plans to buy. This strategy acts as insurance against potential losses on the underlying asset. The put option provides a floor price below which the investor’s losses are limited. This is particularly useful for investors who are bullish on the long-term prospects of an asset but want to protect against short-term market volatility.

The cost of the put option is the premium paid, which reduces the overall potential profit if the asset’s price appreciates significantly. For instance, an investor anticipating buying 100 shares of ABC at $60 might simultaneously purchase a put option with a strike price of $55 to protect against a significant price drop.

Advanced Options Strategies: Risk and Reward

| Strategy | Risk | Potential Reward | Description |

|---|---|---|---|

| Bull Call Spread | Limited; maximum loss is the net premium paid. | Limited; maximum profit is the difference between the strike prices minus the net premium paid. | Buying a call option with a lower strike price and selling a call option with a higher strike price. |

| Bear Put Spread | Limited; maximum loss is the difference between the strike prices minus the net premium received. | Limited; maximum profit is the net premium received. | Buying a put option with a higher strike price and selling a put option with a lower strike price. |

| Covered Call Writing | Limited upside potential; risk of shares being called away. | Premium received plus potential appreciation up to the strike price. | Selling call options on shares already owned. |

| Protective Put | Premium paid; limited downside protection. | Unlimited upside potential; downside limited to the strike price minus the premium paid. | Buying a put option to protect against losses on an underlying asset. |

Illustrative Examples of Options Trades

Understanding options trading is best done through practical examples. These illustrations showcase both successful and unsuccessful trades, highlighting the potential for profit and loss, as well as the use of options for hedging and income generation. Remember, these are hypothetical scenarios and actual results may vary.

Successful Options Trade: Buying a Call Option

Let’s say XYZ Corporation is currently trading at $50 per share. You believe the stock price will rise significantly in the next few months. You purchase one call option contract with a strike price of $55 and an expiration date three months out for a premium of $2 per share. The contract covers 100 shares. Your total cost is $200 ($2 premium x 100 shares).

If the stock price rises to $65 before the expiration date, your option becomes “in the money.” You can exercise the option to buy 100 shares at $55 and immediately sell them at $65, realizing a profit of $10 per share, or $1000, minus your initial $200 premium, resulting in a net profit of $800.

Unsuccessful Options Trade: Selling a Put Option

Suppose you believe a stock, ABC Corp, currently trading at $25, is unlikely to fall below $20. You sell one put option contract with a strike price of $20 and an expiration date of one month, receiving a premium of $1 per share. Your total premium received is $100 ($1 x 100 shares). However, unexpected negative news causes ABC Corp’s stock price to plummet to $15.

Your put option is now “in the money,” meaning the buyer can exercise their right to sell you 100 shares at $20. You are obligated to buy these shares at a loss, costing you $5 per share, or $500, and even after receiving the initial $100 premium, you have a net loss of $400. This highlights the significant risk associated with selling options.

Hedging with Options: Protective Put

Imagine you own 100 shares of DEF Corp, currently trading at $100, and are concerned about a potential market downturn. To protect your investment, you buy a put option with a strike price of $95 and an expiration date of three months. Let’s say the premium costs $3 per share, or $300 total. If the stock price remains above $95, the put option expires worthless, and your only loss is the $300 premium.

However, if the stock price falls to $80, your put option allows you to sell your 100 shares at $95, limiting your loss to $1,500 (difference between $100 and $95) plus the premium of $300, for a total loss of $1800. This is significantly less than the $2000 loss you would have incurred without the protective put.

Generating Income with Options: Covered Call Writing

You own 100 shares of GHI Corp trading at $75 and believe the price is unlikely to rise significantly in the near future. You write (sell) one covered call option with a strike price of $80 and an expiration date of one month. You receive a premium of $2 per share, earning $200. If the stock price remains below $80, the option expires worthless, and you keep the $200 premium as profit.

If the stock price rises above $80, your shares will be called away at $80, generating a profit of $5 per share plus the $2 premium, totaling $700 profit. This strategy generates income while potentially limiting upside gains.

Resources for Further Learning

Successfully navigating the world of options trading requires continuous learning and refinement of skills. This section provides a curated list of resources to support your journey, encompassing websites, books, and financial news outlets. These resources offer diverse perspectives and learning styles to cater to individual needs and preferences.

Reputable Websites and Educational Resources

Many online platforms provide valuable educational content on options trading. These resources range from interactive tutorials to in-depth analysis, offering a diverse learning experience for traders of all levels. Choosing the right platform depends on your learning style and preferred level of engagement. Some platforms offer free resources, while others may require subscriptions for premium content. Always carefully evaluate the credibility and reliability of any online resource before incorporating its information into your trading strategy.

- Investopedia: Investopedia offers a comprehensive collection of articles, tutorials, and definitions related to options trading and broader financial topics. Their explanations are generally clear and accessible to beginners.

- Option Alpha: Option Alpha provides educational content, analysis, and trading strategies, often focusing on practical applications. They offer both free and paid resources.

- Tastytrade: Tastytrade offers a unique approach to options education, emphasizing risk management and defined-risk strategies. Their videos and educational materials are generally quite engaging.

- The Options Industry Council (OIC): The OIC is a non-profit organization that provides educational resources and information about the options market. Their materials tend to be more formal and detailed.

Recommended Books for Beginners in Options Trading

Books offer a structured and in-depth approach to learning about options trading. They provide a solid foundation in the fundamentals and often delve into more advanced concepts. Selecting books tailored to your learning style and current knowledge level is crucial. Remember that the options market is dynamic; always supplement book knowledge with current market analysis.

- “Options as a Strategic Investment” by Lawrence G. McMillan: This comprehensive guide is often considered a classic text for options trading, covering various strategies and risk management techniques.

- “The Options Playbook: Trading Options Strategies to Achieve Your Financial Goals” by Michael Sincere: This book focuses on practical options strategies and their application in different market conditions.

- “Understanding Options” by Michael S. Harris: This book provides a clear and concise explanation of options contracts and their underlying mechanics. It’s particularly well-suited for beginners.

Relevant Financial News Sources

Staying informed about market trends and news is crucial for successful options trading. Reliable financial news sources provide up-to-date information, analysis, and insights that can influence trading decisions. It’s important to diversify your sources to gain a comprehensive understanding of market dynamics. Be aware that some sources may present biased or speculative information, so critical evaluation is essential.

- Bloomberg: Bloomberg provides in-depth financial news, analysis, and data across various asset classes, including options. Their coverage is known for its comprehensive nature and professional tone. [Note: Access may require a subscription.]

- Financial Times (FT): The FT offers insightful commentary and analysis on global financial markets, including options trading. Their articles often provide a broader economic context for market movements. [Note: Access may require a subscription.]

- Reuters: Reuters provides real-time news and data on financial markets, offering a quick and reliable source of information for traders. Their coverage is extensive and spans numerous global markets. [Note: Access may require a subscription.]

- Yahoo Finance: Yahoo Finance offers a free platform with news, stock quotes, and financial data, including information relevant to options trading. While less in-depth than some paid sources, it provides a convenient overview of market conditions.

Successfully navigating the stock options market requires a blend of knowledge, strategy, and discipline. This guide has provided a foundational understanding of the key elements involved in buying stock options, from grasping the terminology to executing trades and managing risk effectively. Remember, thorough research, careful planning, and a commitment to continuous learning are crucial for long-term success in this dynamic investment arena.

Embrace the learning process, and approach options trading with a well-defined strategy and a realistic understanding of the inherent risks.

Quick FAQs

What is the minimum amount I need to start options trading?

The minimum amount varies greatly depending on your brokerage. Some brokers may allow you to start with a small account balance, while others may have higher minimums. Check your broker’s specific requirements.

How often do stock options expire?

Stock options have various expiration dates, ranging from weekly to monthly, and even longer-term options are available. The expiration date is a crucial factor to consider when choosing an option contract.

What are the tax implications of options trading?

The tax implications of options trading can be complex and depend on your specific situation and the type of options trades you execute. Consult a tax professional for personalized advice.

Can I lose more money than I invest in options trading?

Yes, options trading carries the potential for substantial losses exceeding your initial investment. This is due to the leveraged nature of options contracts.